Tourist Board Membership Fee for 2019

We would like to remind you of your tourist board membership fee payment obligation determined in accordance with the Tourist Board Membership Fee Act (OG 152/08).

Pursuant to the Regulations on the Form and Content of Information Concerning the Basis for the Calculation of the Tourist Board Membership Fee (OG 119/09), membership fee reports for 2019, prepared on the „TB Form“ („Obrazac TZ“), must be submitted to the Tax Authority by end of February 2020.

We are reminding you that the basis for calculating the tourist board membership fee is the total revenue achieved in 2019, as evidenced in the turnover section of the general ledger or the EP Form multiplied by the corresponding coefficient of the place where the activity is performed: 0,16150% for facilities in the area of Rovinj (Class A) and 0,12920% for facilities in the Rovinjsko Selo area (Class C).

The Tourist Board Membership Fee Report Form is available for purchase at bookstores or you can download it from http://www.porezna-uprava.hr/HR_obrasci (under Forms - Other).

INSTRUCTIONS FOR COMPLETING THE PAYMENT ORDER:

Payee: State Budget of the Republic of Croatia, Tourist Board of the Town of Rovinj - Rovigno

Model: HR67

IBAN: HR6610010051737427159

Reference Number: PIN (OIB) of the Accommodation Owner (Renter)

Description of Payment: Tourist Board Membership Fee

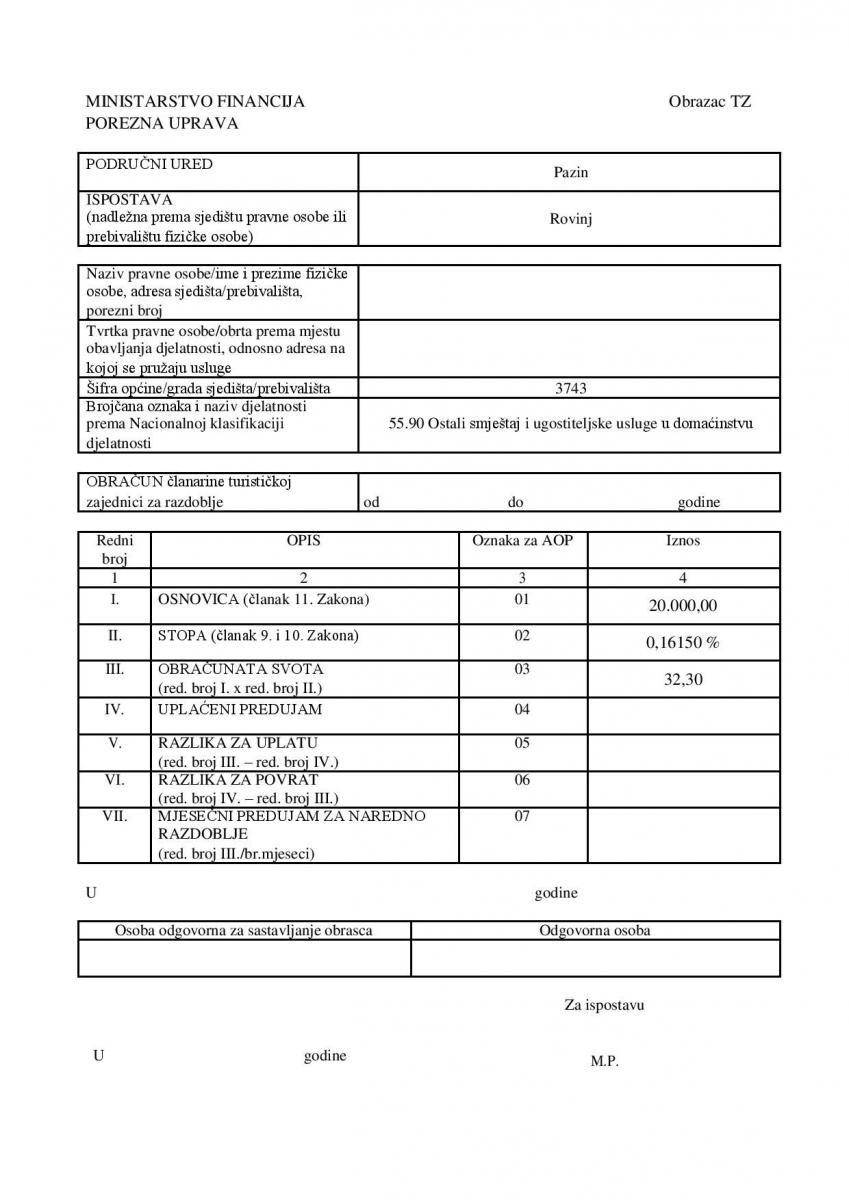

EXAMPLE OF FULLFILLMENT OF THE TB FORM FOR WHOM HAVE FACILITIES IN ROVINJ:

An example of a calculation, if the total revenue amounts to 20,000.00kn, the calculation is: 20,000.00 x 0,16150% = 32,30kn

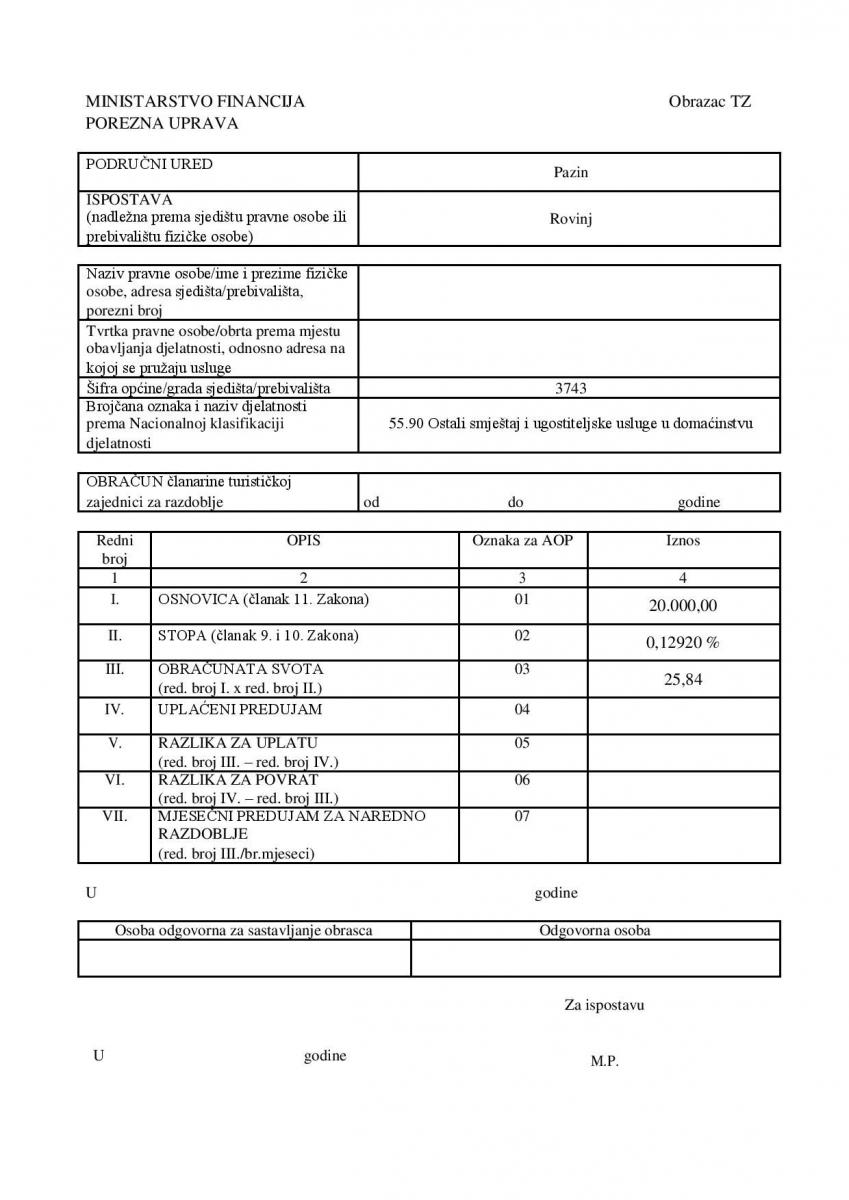

EXAMPLE OF FULLFILLMENT OF THE TB FORM FOR WHOM HAVE FACILITIES IN ROVINJSKO SELO:

An example of a calculation, if the total revenue amounts to 20,000.00kn, the calculation is: 20,000.00 x 0,16150% = 32,30kn

According to Article 3 of the Tourist Board Membership Fee Act (Official Gazette 152/08),

- A legal or natural person that has in a tourist municipality or town its registered office or branch office, facility or establishment in which a service or the like is provided and obtains revenue on a permanent or seasonal basis by providing hospitality services, tourist services or by performing activities directly relating to tourism shall pay a membership fee to the tourist board.

- A person that is funded with over 50% from the municipal, town, county or national budget is not required to pay a tourist board membership fee.

- The amount of the membership fee payable by a legal or natural person as a full member of the town’s tourist board shall depend on the tourism class of the settlement in which such person has its/his registered office or business unit, on the group in which the activities performed by such legal or natural person are classified, and on the rate applicable to the total revenue as defined by this Act.

- Such legal or natural person as referred to in paragraph 1 of this Article may also pay the membership fee at the rate defined for the activities performed by such person to a greater extent in relation to the other activities for which such person is registered in the registry of the relevant commercial court or the state administration office in the relevant county based on the total revenue if this is more favorable for such person.

According to Article 11of the Tourist Board Membership Fee Act (Official Gazette 152/08),

- The calculation of the membership fee for a legal or natural person subject to corporate income tax shall be based on the total revenue including all revenue that such person is required to disclose in the income statement, in accordance with the relevant accounting regulations.

- The calculation of the membership fee payable by a natural person subject to personal income tax shall be based on the total receipts specified in the receipts ledger minus value added tax paid.

- A special base and total revenue for membership fee calculation purposes shall be determined for each business unit outside the jurisdiction of a legal or natural person’s registered office.

- The base for the calculation of the membership fee payable by a legal or natural person shall be reduced for the part of such person’s revenue obtained in business units located outside the tourism area in which such legal or natural person has its/his registered office.

- Where a legal or natural person engages in several classes of activity for which such person is required to pay a membership fee, the calculation of the membership fee shall be based on the total revenue obtained from the prevailing activity subject to the membership fee.

According to Article 12 of the Tourist Board Membership Fee Act (Official Gazette 152/08),

- A legal or natural person shall pay the membership fee on the territory of the town in which such person has its/his registered office and shall pay the membership fee for its/his other business units on the territory of the municipality or town in which such other business unit has its registered office.

- A legal or natural person performing its/his activities without business premises shall pay the membership fee on the territory of the town in which such person performs its/his activities.